New Changes to Income Tax Nr. 29/2023

In accordance with Article 101 of the Constitution, with the proposal of the Minister of Finance and Economy, the Council of Ministers

DECIDES:

In Law No. 29/2023, "On income tax," as amended, the following changes and additions are made:

Article 1

In paragraph 1 of Article 65, the words "... and no later than the 20th day of the month following each 3-month period for self-employed individuals or traders." are replaced with "... and self-employed individuals or traders registered for VAT, and no later than the 20th day of the month following each 3-month period for self-employed individuals or traders, who are not registered for VAT.

Every employer who is obligated to pay employment income is required to withhold the tax on these incomes, submit the payroll list, and transfer the withheld tax in the payroll list to the treasury budget account no later than the 20th day of the following month for entities and no later than the 20th day of the month following each 3-month period for self-employed individuals or traders. and self-employed individuals or traders registered for VAT, and no later than the 20th day of the month following each 3-month period for self-employed individuals or traders who are not registered for VAT.

Article 2

In Article 69, the following additions and changes are made:

e) For all taxpayers, registered before December 31, 2023, who are subject to simplified profit tax or profit tax, as well as those who register for the first time in the subsequent year, for the tax period of 2024, forms and tax responsibilities will be used in accordance with Law No. 9632, dated October 30, 2006, 'On the local tax system,' as amended, and Law No. 8438, dated December 28, 1998, 'On income tax,' as amended;

Advance payments, according to Article 63 of this law, for categories of individuals providing professional services and are subject to income tax from January 1, 2024, except for the year 2024, are calculated based on the simplified profit tax and profit tax declarations of previous years, applying the tax rates stipulated in this law.

f) The source withholding tax return, according to Article 57 of this law, will be implemented starting from the tax period of January 2025. For the year 2024, the existing model declaration will be used.

In paragraph 2, the words "... until December 31, 2023 ..." are replaced with "... until December 31, 2024

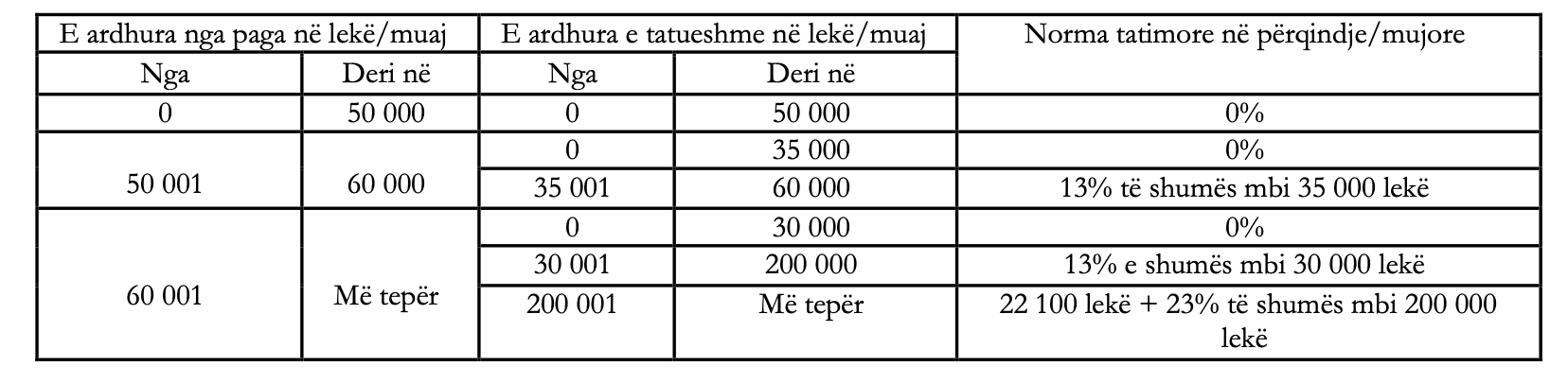

The personal income tax table for the period from June 1, 2023, to December 31, 2024.

In paragraph 5, at the end of the sentence, the words '..., excluding the letters "e," "ë," and "f," of this article, the implementation of which will be done according to the provisions of Law No. 8438, dated December 28, 1998, 'On income tax,' as amended, until December 2024

Until the effective date of this law, according to the provision of Article 72, the provisions of Law No. 8438, dated December 28, 1998, 'On income tax,' as amended, are applied, except for the letters 'e,' 'ë,' and 'f' of this article, the implementation of which will be done according to the provisions of Law No. 8438, dated December 28, 1998, 'On income tax,' as amended, until December 2024.

Article 3

In Article 72, after the words '... January 1, 2024, except for ...' the words '... to Articles 22, 23, 24, paragraph 1, which take effect from January 1, 2025, ...' are added.

This law enters into force 15 days after publication in the Official Gazette and applies from January 1, 2024, with the exception of the letter 'ç' of paragraph 1 of Article 69, which takes effect upon the entry into force of this law, and paragraph 2 of Article 69, which takes effect from June 1, 2023, to Articles 22, 23, 24, paragraph 1, which extend the effects from January 1, 2025.

https://www.hlb.al/wp-content/uploads/2023/12/akt-normativ-2023-12-14-7-1.pdf